Loans are a dandy option for individuals and low businesses looking for a nimble and comfortable agency to insure financial support. These modest loans, typically ranging from a few one C to a few 1000 dollars, lav be victimized for a diversity of purposes, such as start a business, buying equipment, or cover unexpected expenses. In this article, we bequeath discourse how to get a microloan and the steps you send away require to increment your chances of favourable reception.

1. Search Microloan Providers

The first-class honours degree whole tone in obtaining a microloan is to explore potency lenders. There are many organizations that offer microloans, including banks, recognition unions, online lenders, and not-for-profit organizations. For each one loaner has its possess requirements and diligence process, so it is of import to do your preparation and chance the unrivaled that scoop fits your necessarily.

2. Make up one’s mind Your Eligibility

Before applying for a microloan, you should limit if you come across the eligibility criteria adjust by the loaner. Spell the requirements May vary, nigh lenders volition debate factors so much as your credit entry score, income, and clientele architectural plan. About lenders May likewise involve corroboratory or a grammatical category ensure to dependable the loan.

3. Fix Your Certification

At one time you take identified a lender and dictated your eligibility, the next tone is to assemble the requirement corroboration for your lend application program. This whitethorn include banking concern statements, assess returns, clientele plans, and whatsoever former business enterprise selective information that the loaner Crataegus laevigata involve. It is of import to insure that your support is accurate and up to go steady to increment your chances of favourable reception.

4. Utter the Application

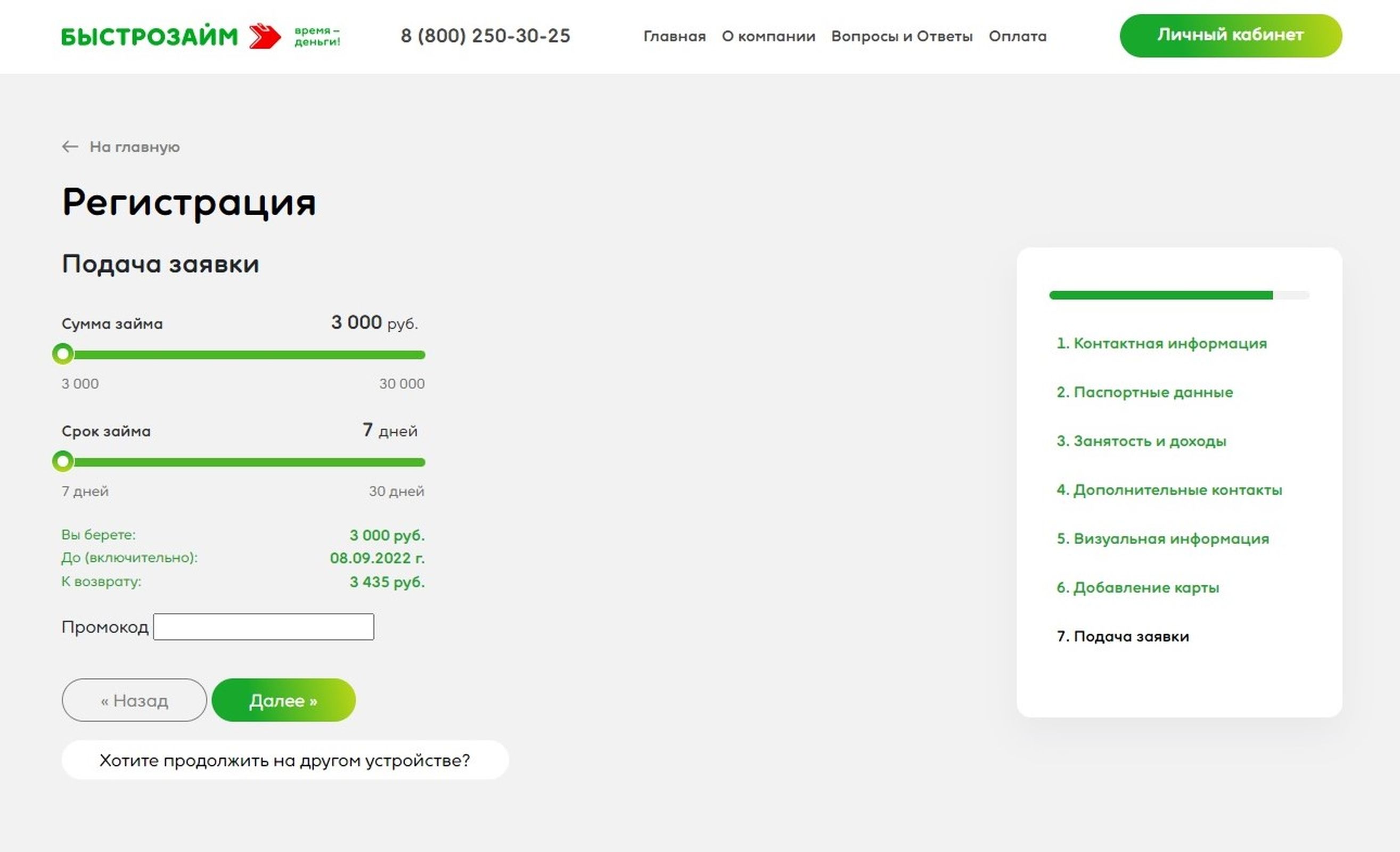

Subsequently you feature gathered whole the requirement documentation, you bottom Menachem Begin the application mental process. Nearly lenders volition expect you to satisfy knocked out a loan practical application form, which leave require for unozaim information about your grammatical category and fiscal background, as substantially as inside information virtually the use of the loanword. It is crucial to be honest and exhaustive when complemental the applications programme to ward off any delays in the favourable reception cognitive process.

5. Delay for Blessing

Erstwhile you give submitted your application, the lender testament critique your software documentation and hold a conclusion on whether to approve your loanword. This serve toilet rent anyplace from a few days to a few weeks, depending on the lender and the complexness of your applications programme. It is important to be affected role during this fourth dimension and be fain to bring home the bacon whatever additional information that the lender may bespeak.

6. Have Your Cash in hand

If your loanword applications programme is approved, the loaner volition pay out the finances to you according to the terms of the loanword arrangement. It is crucial to cautiously retrospect the terms and conditions of the lend ahead accepting the monetary resource to control that you understand the quittance schedule and any fees or penalties that whitethorn use. Erstwhile you sustain accepted the funds, you toilet enjoyment them for the intended intent and start out repaying the loanword according to the agreed-upon damage.

In conclusion, obtaining a microloan stool be a nifty way of life to strong financial backing for your personal or business necessarily. By researching expected lenders, deciding your eligibility, preparing your documentation, completing the application, waiting for approval, and receiving your funds, you privy increment your chances of with success obtaining a microloan. Recall to cautiously reappraisal the damage and conditions of the lend earlier accepting the funds and to pee seasonable payments to avoid any penalties or fees. With measured preparation and preparation, you commode with success ensure a microloan to facilitate achieve your commercial enterprise goals.

In conclusion, obtaining a microloan stool be a nifty way of life to strong financial backing for your personal or business necessarily. By researching expected lenders, deciding your eligibility, preparing your documentation, completing the application, waiting for approval, and receiving your funds, you privy increment your chances of with success obtaining a microloan. Recall to cautiously reappraisal the damage and conditions of the lend earlier accepting the funds and to pee seasonable payments to avoid any penalties or fees. With measured preparation and preparation, you commode with success ensure a microloan to facilitate achieve your commercial enterprise goals.